When my parents were young adults in the 50’s and 60’s the idea of using credit cards was quite new to them.

I was brought up to believe that if you didn’t have the money for something you went without until you had saved enough to buy it.

As a kid at school the amount of pocket money I was given was enough to buy a few penny sweets and perhaps a sherbet dib dab! I very quickly learned that if I wanted something of value I should use my initiative in order to find a way of earning the money to pay for it – or wait for a special occasion such as Christmas or a birthday in the hope that the Gods might look favourably upon me!

Many people will remember 1966 as the year in which the England football team won the World Cup, but not so many will realise that it was also the year in which new credit facilities were making huge changes to the way in which people could buy goods. By 1972 Access credit card had launched with a clever marketing slogan, “Access Your Flexible Friend”.

The Access credit card was one of the first credit card companies to advertise heavily on television. In the first adverts “Money”, “Cheque Book” and “Credit Card” were portrayed as human characters. “Credit Card” was always stepping in and getting “Money” out of financial dilemmas caused by “Cheque Book’s” inadequacy! After a run of adverts during the 70’s “Credit Card” finally become “Money’s” new best friend! If you look back at some of the old adverts on You Tube I think you would have to agree that this was very clever and entertaining marketing.

If the adverts by Access had continued through the decades we might have seen a civil wedding between “Credit Card” and “Money”. However, in the light of the bad publicity surrounding the credit card debt built up by some consumers, perhaps a divorce would have been more suitable!

Debt in the UK has played a big part in families breaking down and a large proportion of children in this country now come from broken homes. Sadly, this can mean that, in some cases, parents try to buy their children’s affection to make up for the limited amount of time they are spending with them and it puts them in a difficult position when it comes to discussing financial matters and teaching by example.

Fortunately, Personal Health and Social Education (PSHE) will become a statutory part of the National Curriculum in 2011 and will teach primary and secondary children about personal finance as well as discussing topics including drugs, alcohol, health, well-being, sex, relationships and nutrition. Future generations will have the advantage of learning important life skills and entering into discussions on subjects, some of which, in the past, have been considered not suitable for conversation in polite circles!

Today it would be difficult to imagine going about our everyday business without the use of debit cards and credit cards, so all the more reason for us, and especially for our children, to learn everything we can about how to use them wisely.

If you use a credit card sensibly and pay the balance off in the agreed time each month, it could cost you nothing to use. Many cards give you the added benefit of purchase protection insurance. This is great for peace of mind when shopping on the Internet as you will be covered against loss, damage and theft for a period of time. Always remember to check the credit company’s full terms and conditions.

Before applying for a credit card it is important to work out how you are going to use the card and to ask yourself, “Can I afford to pay back the amount I am borrowing?”

Find out the cost of making cash withdrawals and transferring debts from other cards.

Do you have a plan B if your circumstances suddenly change?

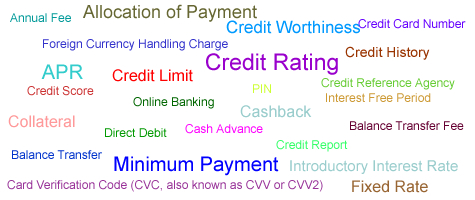

Are you one of the many hundreds of individuals who struggle to understand the financial jargon and glossary terms in the small print? A new campaign, “Credit Made Clearer” explains all the terms for you.

If you are considering applying for a credit card you will no doubt find a huge selection of different types of cards and interest rates. Your chance of being accepted as a customer depends on your credit history. Some lenders categorise their cards into sections as simple as – Very Good Credit History – Good History – Rebuilding Credit History.

The better your credit history the better the interest rates you will be offered!

The most credit worthy applicants will typically be offered the lowest variable annual percentage rate (APR). If you start out at a variable rate it will typically be below a fixed rate, but remember it could rise in the future raising the minimum payment, which could make it difficult to pay off a credit card bill each month. Falling behind with payments could adversely affect your credit score.

If for any reason you find yourself in a position where you’re struggling to keep up with your credit card payments, the worst thing you can possibly do is to bury your head in the sand and just hope the problem goes away. Grab hold of the opportunity to do something positive about it. The best way to get to the root of the problem and to solve your debt worries is to talk to someone about them. Call the companies with which you have credit. In most cases they can offer you help and information on paying off your debt

What happens if you cannot come to an agreement with your lender?

National Debtline

Telephone helpline for people with debt problems in England, Wales and Scotland. The service is free, confidential and independent. If you’re looking for advice on a debt problem there are several ways you can obtain help and information.

The helpline provides FREE CONFIDENTIAL and INDEPENDENT ADVICE on how to deal with debt problems.

Citizens Advice

Information to help you sort out how much money you owe and work out which are the most important debts to pay first.