Do You Auto-Renew Your Breakdown Cover?

Do you find that staying loyal to a company means paying more once they have hooked you in with their introductory offer?

These days businesses that supply a product or service may not be giving loyal customers the best value for money anymore.

This typical for services like:

- Car Insurance

- Content Insurance

- Pet Insurance

- Breakdown cover

The Most Expensive Time To Get Breakdown Cover!

When I broke down travelling to Bournemouth I didn’t have breakdown cover so I joined the AA at the roadside. This cost me a substantial amount more money than if I had bought the service before needed to use it. This is normal or everyone would risk not having breakdown cover and join only when they breakdown.

The price I paid at the roadside dealt with the immediate problem and got me, my family and car home safe and sound. The price I paid also included cover for the next 12 months should I need to use the breakdown service again.

When the annual renewal came through it was cheaper than the amount I paid at the roadside, but it was still over £60.00 more than a new member would pay. (I still wanted to stay with the AA as the service I received was brilliant)

Don’t Just Renew – Ring up, negotiate or cancel

I rang the AA press office to ask why as a member it was more than a new customer. I was told that existing members receive other benefits such as:

- invitations to once-in-a-lifetime events

- exclusive money-can’t-buy competitions and giveaways

- fantastic features on motoring, travel and food

- special offers and discounts

As I had already tried to use one of the “discounts” offered as valued member for my car insurance quote (£650 more than the cheapest quote I received from other leading insurers!) For the extra cost and benefits offered, I couldn’t see enough value in the “other” member benefits. I cancelled my policy and joined again as a new member so I could grab a deal! (Doesn’t make sense and must cost companies more money to set up as NEW again!?

Can You Get The Same Cover Cheaper?

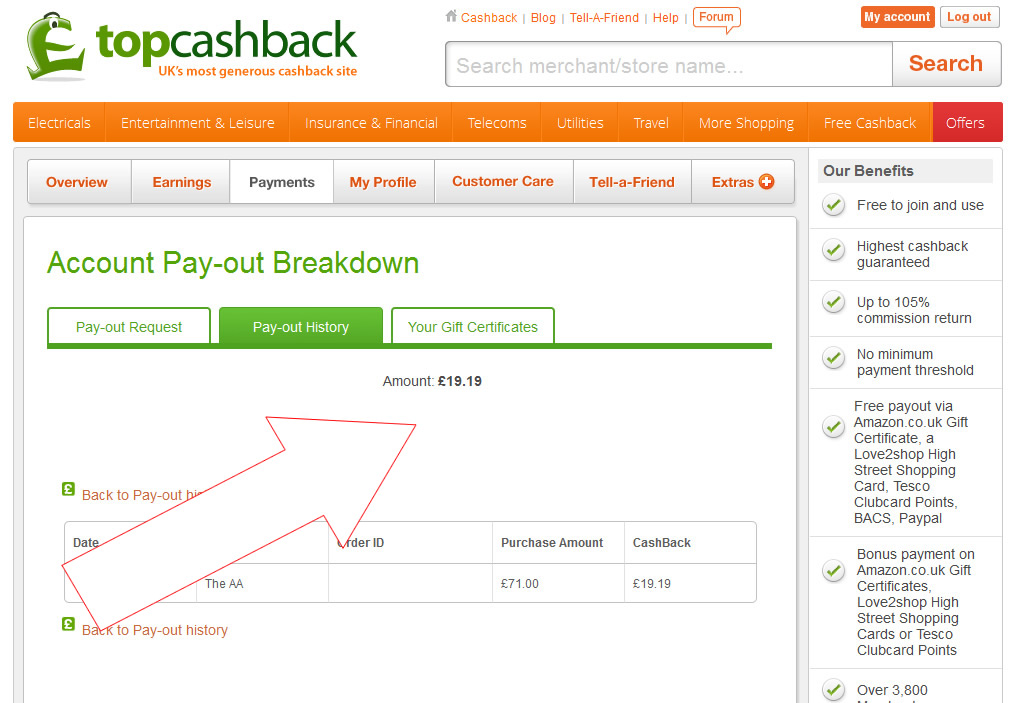

The breakdown cover I wanted was £71.00 on the AA website at the time. I bought cover using the cashback website (www.topcashback.co.uk) I still paid £71.00, but the cashback website sent me £19.19 back after a couple of months. This meant I actually paid £51.81 for the same cover which would have been £121.00 as a member. (Saving £69.19)

It is always worth checking out the prices of other companies that offer breakdown cover too. I have listed my top three and also included a couple of cashback websites where you may be able to get a cashback as I did. (It’s not guaranteed)

Resources:

A couple of Great Cashback Websites

Learn about cashback sites:

We have re-worked this article to add more resources to help you save even more. Please leave your comments below or use the social media buttons to share this article with friends.